注:開發小程序請查看小程序基本運營規範,另目前並非所有類目均已向個人開發者開放,個人開發疫情類相關小程序,請務必先查看開放類目,且需注意: 1,小程序涉及到的數據或者接口需要來自於政府渠道或有公信力的官方機構,並標明來源或者出處; 2.小程序內不能發起募捐活動。

|

全民積極響應國家抗擊新冠肺炎疫情的號召,正催生出越來越多新的互聯網服務缺口。當醫護人員奮戰在一線,直面疫情時,開發者們同樣也能用自己的一技之長為社會獻一份力。如果您願意為戰疫情貢獻自己的力量,請填寫以下報名表申請阿里資源傾斜。

注:開發小程序請查看小程序基本運營規範,另目前並非所有類目均已向個人開發者開放,個人開發疫情類相關小程序,請務必先查看開放類目,且需注意: 1,小程序涉及到的數據或者接口需要來自於政府渠道或有公信力的官方機構,並標明來源或者出處; 2.小程序內不能發起募捐活動。

0 Comments

恭喜恭喜各位商戶

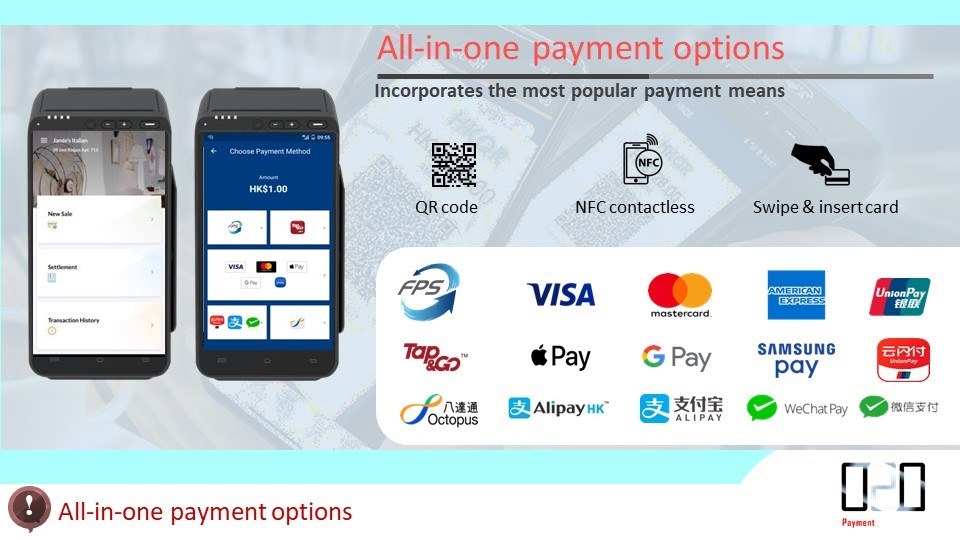

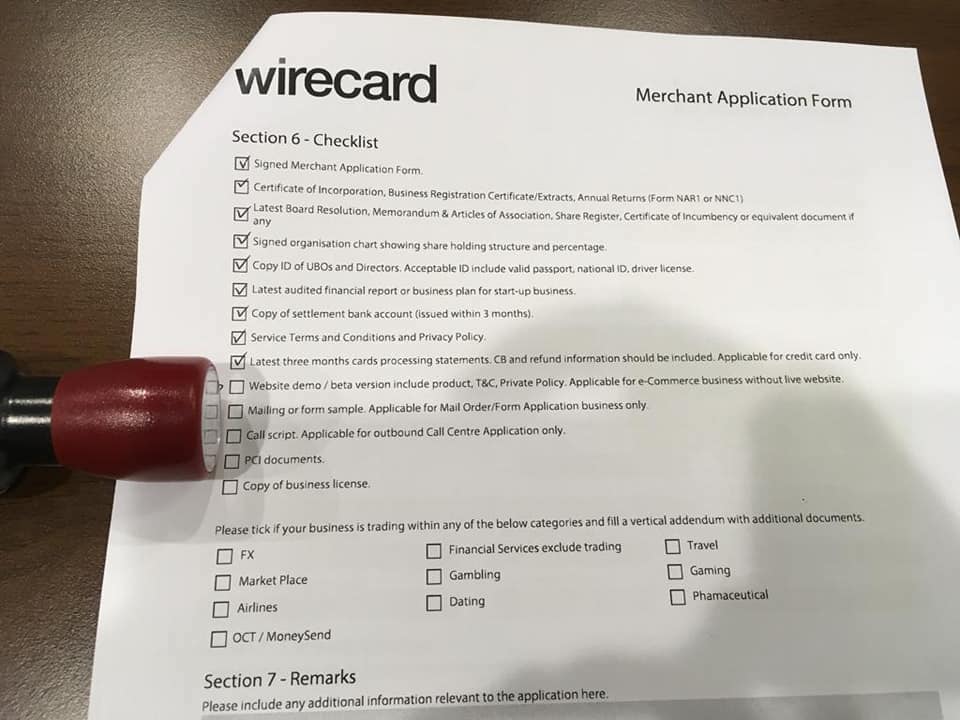

2019年3月開始,可以接受Visa Master銀聯 <信用卡商戶號>的申請了! 最重要,比銀行更加容易申請,而且除咗舖頭用...用喺網站收錢都可以㗎!! 卡機及文件規格參考: https://usa.visa.com/…/visa-merchant-data-standards-manual.… 有關服務由WireCard (前citibank信用卡)服務提供. South China Morning Post –04 Mar

Stelux in sight of China turnaround on Boyu vision Stelux Holdings, a Hong Kong-based retailer of mid-priced spectacles and watches, said its co-operation with the private equity firm Boyu Capital creates operating synergies that will help it to turn around its China business within three years, aided by online sales and relocation to second-tier cities. Joseph Wong, chairman and chief executive of Stelux, which operates the Optical 88 and City Chain stores, said: “Boyu Capital offers industry expertise and seasoned managers in the competitive middle-class industry on the mainland, creating more synergies than its investment in our company.” Boyu Capital, a private equity firm specialising in China investment founded by former Ping An president Louis Cheung and Mary Ma, invested in the retailer through a subscription for HK$371 million of convertible bonds in November. Stelux appointed Ma, a former chief financial officer at Lenovo and executive at US-based Texas Pacific Group, and Boyu’s Alex Wongas non-executive directors responsible for its expansion plan on the mainland. Joseph Wong said he believed that Ma and Alex Wong would control costs with the aim of breaking even in the financial year 2015. Joseph Wong, 52, who took the helm at Stelux in October 2011, said the two parties had been in private discussion since April last year and subsequently appointed an external consulting firm to lay out new strategy in China, where it will roll out an online shopping site in September this year, and shift its retail network into second-tier cities. Retail in Asia –04 Mar

GSMA survey identifies 30m active mobile money customers in 2012 http://www.retailinasia.com/article/tech/technology/2013/03/gsma-survey-identifies-30m-active-mobile-money-customers-2012 The number of active mobile money users globally grew impressively in 2012, with more than 30 million people undertaking 224.2 million transactions totaling $4.6 billion during the month of June 2012 alone. GSMA’s Mobile Money for the Unbanked (MMU) program, which released the figures in a recent report, said the industry is also becoming increasingly competitive, with 40 markets identified as having at least two different mobile money services available. In 2012, about 41 live mobile money services were launched. “The social impact of mobile money is already well documented, and our report last year offered the first global benchmarks on how many customers were using mobile money,” said Chris Locke, Managing Director, GSMA Mobile for Development. “Following our second Mobile Money Adoption Survey, we are able to share deeper insights on the number of customers, on how customers are actually using the service and, perhaps more importantly, on how successfuloperators are positioning and managing mobile money to meet the needs of those customers.” The GSMA report counted 81.8 million registered customers globally and with the total number of deployments on a global basis growing by almost 38 percent. Interestingly, it showed that there are now more mobile money accounts than bank accounts in Kenya, Madagascar, Tanzania and Uganda, and more mobile money agent outlets than bank branches in at least 28 countries. In some countries, the total value of mobile money transactions is equivalent to a significant proportion of the country’s overall GDP. In June 2012, it was equivalent to more than 60 percent of GDP in Kenya, more than 30 percent of GDP in Tanzania, and more than 20 percent of GDP in Uganda. Retail in Asia –04 Mar Expert Opinion: Critical technology insights for today’s retail environment http://www.retailinasia.com/article/tech/technology/2013/03/expert-opinion-critical-technology-insights-today%E2%80%99s-retail-environme IT Tech Now –02 Mar

Samsung Wallet similar to Passbook? Samsung 也正投入iOS「Passbook」般的電子票券功能? http://www.technow.com.hk/samsung-ios-passbook/ 根據気になる、記になる… 網站轉述9 to 5 Mac 消息,稍早Samsung 發表的「Samsung Wallet」功能,由於被認為與Apple iOS 作業系統「Passbook」相像,因而成為新聞話題。 發表當時的影片實況如下,大致上介面近似「Passbook」概念,功能上亦能提供活動、會員、優惠、交通工具搭乘等票券的管理,不過這項功能是否會正式釋出,現階段則尚不明朗。 Engadget (Trad. Chinese) –02 Mar

Samsung NFC mobile payment at vending machines Samsung NFC 手機付款自動販賣機中文動手買 http://chinese.engadget.com/2013/03/01/samsung-nfc-mobile-payment-chinese-hands-on/ 來到2013 年,香港將慢慢的進入NFC 流動支付時代。隨著PCCW 宣佈今年與恒生銀行合作推出MasterCard PayPass 付款服務,我們可以想像未來只要拿起手機就可以付款了。這次在西班牙這邊,Samsung 也展示相關的技術,我們可以看到一台自動販賣機配備了支援NFC 付款的裝置,其支援Visa PayWave 及MasterCard PayPass。我們只要拿起已進行銀行聯網的NFC 手機,在黃色的裝置上觸控便可以進行付款,並通過螢幕看到付款的狀態。這個功能即使在螢幕關閉的狀態下(手機是要開機的啦!)也可以做到,不別開啓特別的Apps,也算是一個方便的做法。跳轉看我們的動手買影片,你會更直接明瞭一點。 |

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed